how to calculate a stock's price

The calculation is simple. Just follow the 5 easy steps below.

A Bulletproof Answer To A Popular Job Interview Question Https Www Youtube Com Watch V Fcjcdpwqsoo Interview Questions Job Interview Questions Job Interview

Calculating Todays Stock Prices.

. Dividend Yield Annual Dividend Per Share Current Price Per Share 100. This stock gain calculator also gives you an instant idea about how much return you can get on. Therefore our capital gain is expected to be 10500 -.

Many investors use ratios to decide if a stock offers a good relative value compared to its peers. Calculating the Sell Price. The Stock Calculator is very simple to use.

P D1 r g Here P current stock price g constant growth rate in perpetuity anticipated for the dividends of the stock. P D 1 r g where. The stock average calculator helps to.

Assume you purchased the financial services stock with a PE ratio of 3 and now you want to calculate the best price to sell. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Cost basis 1050 672 1712 1404 4838.

So how to calculate stocks profit. You can find the total number of shares by adding up the amounts in the middle column of the table. In the example shown Data Types are in column B and the formula in cell D5 copied down is.

Calculating the Estimated stock purchase price that would be acceptable C B DRR001 SGR001 Then the following indicators are computed. We can rearrange the equation to give us a companys stock price giving us this formula to work with. When calculating the dividend yield investors use the annual dividend.

Open an Account Now. Ad No Hidden Fees or Minimum Trade Requirements. Average share price 4838 44 10995.

This week cousin Ake join. - Total you will have to pay to purchase shares D NSB C - Dividend value received in the 1 st year E NSB B - Dividend value received in the 2 nd year F E SGR 001. When a buyer and seller come together a trade is executed and the price at which the trade occurred becomes the quoted market value.

To find the market price per share of common stock divide the common stockholders equity by the average number of outstanding common stock shares. Firstly determine the cost of all stocks including brokers commission using the formula. Put simply the ask and the bid determine stock price.

You need to back into the price using the industry ratio as a threshold. In this article were going to explore how to calculate stock price using a variety of ways including from. Comparing the share prices of similar companies isnt the same as calculating a stocks real value.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. In this case that threshold is 10 and earnings per share have been at 1. The average price of shares equals the total buying price divided by the total number of shares bought.

B5Price The result in column C is the current price for each of the stock Data Types in column B. Companies are categorized to where they fall in the market cap spectrum. 4 ways to calculate the relative value of a stock.

Costs Total number of shares Share purchase price Brokers commission 2. P Current Stock Price g Constant growth rate in perpetuity expected for the dividends r Constant cost of equity capital for that company or rate of. The higher the stocks price rises above the average price of your position the more profit happens.

The equation that the Gordon Growth Model employs is represented as follows. The present value of stock is equal to dividend per share divided by the discount rate from which the growth rate has been subtracted. Investor must wait for at least three days to buy a stock in case there happens to be a sudden fall in the shares price.

Market cap aka market capitalization the PE ratio and other Multiples dividends and free cash flow. The PE ratio equals the companys stock price divided by its most recently reported earnings per. This will give you a price of 667 rounded to the nearest penny.

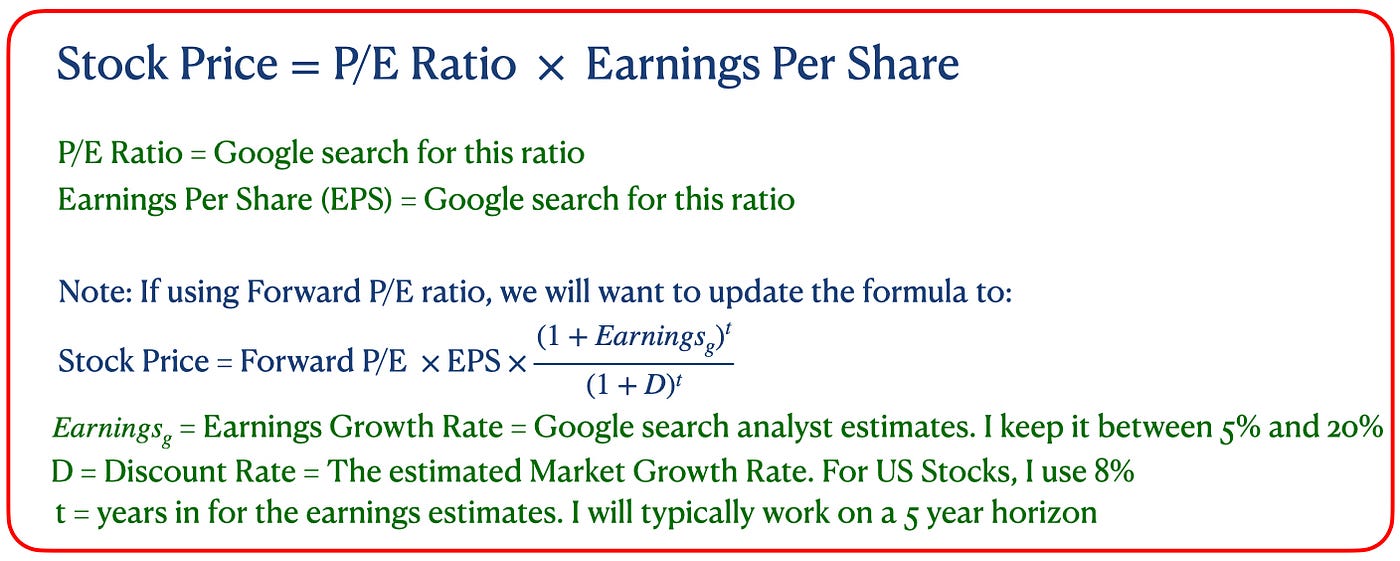

The lower the PE ratio the better and the lower the ratio compared to related companies the better. It is calculated by looking at the stock price relative to the companys earnings and is useful when compared to similar companies in the same industry. The most common way to value a stock is to compute the companys price-to-earnings PE ratio.

Stock price price-to-earnings ratio earnings per share. Price of Stock A is currently 10000 per share or P0. Ad The best tool to help you easily analyze stock data.

Small-cap companies for example are those valued between 300 million to 2 billion while between 2 billion and 10 billion are mid-cap. Last 12-months earnings per share. Generic formula A1Price Summary To get the current market price of a stock you can use the Stocks Data Type and a simple formula.

A market maker in the middle works to create liquidity by facilitating trades between the two parties. Therefore if the dividend is a constant amount paid quarterly or monthly it must be. The free stock calculator allows you to estimate the purchase net break even and sale price of a certain share of stock.

Supplemental Sundays is a live show for the cousins to fill in the gaps together among a broad range of topics within investing. Annual Dividends per share. Dividends are expected to be 300 per share Div.

In this case the adjusted closing price calculation will be 20 1 21. Average Stock Price Calculator developed by ASP is a free stock average price calculator tool that helps users calculate the average share market price quickly. The price of Stock A is expected to be 10500 per share in one years time P1.

The average share price is then found by dividing the total cost by the total shares. You should also be able to find that number on the balance sheet. If you buy the stock at 3 the PE ratio.

Different companies have varying frequencies for dividend payments monthly quarterly or annually. Total shares 10 6 16 12 44. How to Calculate share value Example.

The accurate stocks profit calculation consists of the following steps. For example if a corporations total common stockholder equity is 86 million and its average outstanding common stock value is. Book Value per Share.

Enter the number of shares purchased Enter the purchase price per share the selling price per share Enter the commission fees for buying and selling stocks Specify the Capital Gain Tax rate if applicable and select the currency from the drop-down list optional. To do so multiply the share price by the total number of outstanding shares. Start your trial now.

Track Screen Pick Winning Stocks Faster Beat the Market More Often Demo it Today. Here are the four most basic ways to calculate a stock value.

Stock Investment Calculator Calculate Dividend Growth Model Err Investing Online Stock Online Mortgage

How To Calculate Historical Stock Volatility 12 Steps

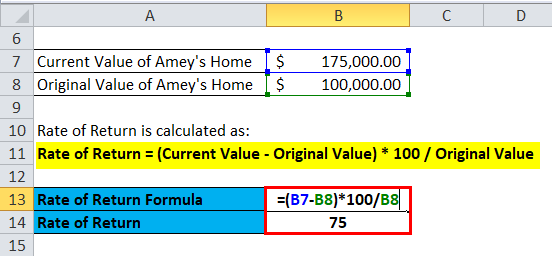

Rate Of Return Formula Calculator Excel Template

Distance Formula Chilimath Distance Formula Midpoint Formula Math Videos

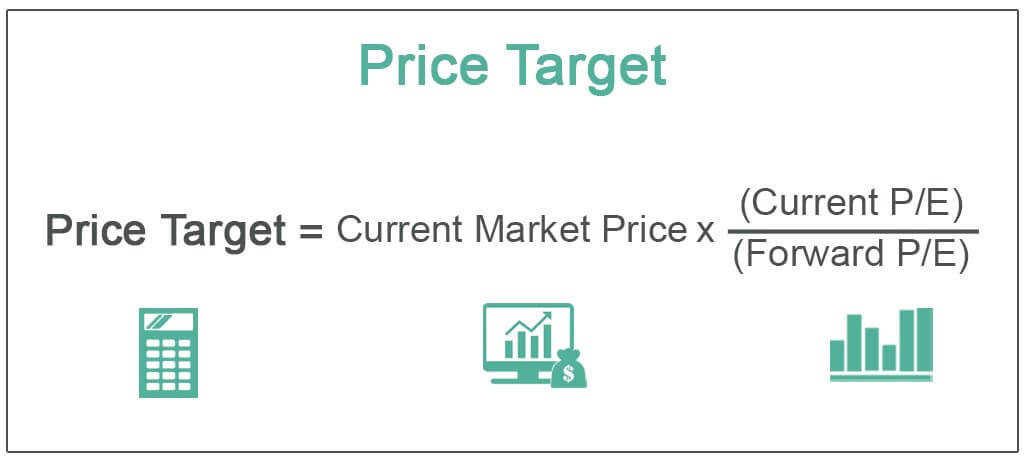

Price Target Definition Formula Calculate Stocks Price Target

Quarterly Average Balance Meaning Calculation Average Meant To Be Balance

Understanding The Gordon Growth Model For Stock Valuation Magnimetrics

The 4 Basic Elements Of Stock Value Marketing Metrics Fundamental Analysis Stock Market

Lookup Historical Stock Split Data For Specific Stocks Starbucks Stock Company Names First Site

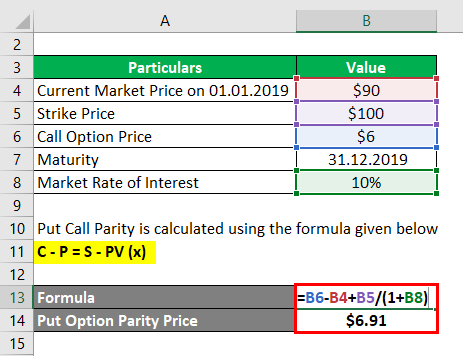

Put Call Parity Formula How To Calculate Put Call Parity

Constant Growth Formula For Stocks By Paul Borosky Mba Youtube

How To Price A Stock Buy Sell Hold Go Long On A Put By Kk Karan Kumar Medium

Intrinsic Value Calculator And Guide Discoverci

Chapter 10 Valuing Stocks Ppt Download

How To Price A Stock Buy Sell Hold Go Long On A Put By Kk Karan Kumar Medium

What Is Stock Beta And How To Calculate Stock Beta In Python

Calculating The Probability Of A Stock Reaching A Given Price In A Specified Time Window In Excel Youtube

How To Price A Stock Buy Sell Hold Go Long On A Put By Kk Karan Kumar Medium

/dotdash_Final_Multiple_Nov_2020-01-5cc7fb72038d42a7a9ea850d8b4c2208.jpg)