operating cash flow ratio industry average

Operating margin Return on sales 97. 220 rows An acceptable current ratio aligns with that of the industry average or might be slightly higher than that.

Price To Cash Flow Formula Example Calculate P Cf Ratio

Cash flow adequacy ratio cash flow from operations Long-term debt fixed assets purchase dividends paid.

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

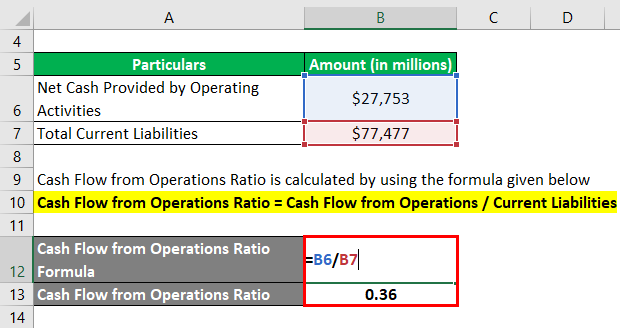

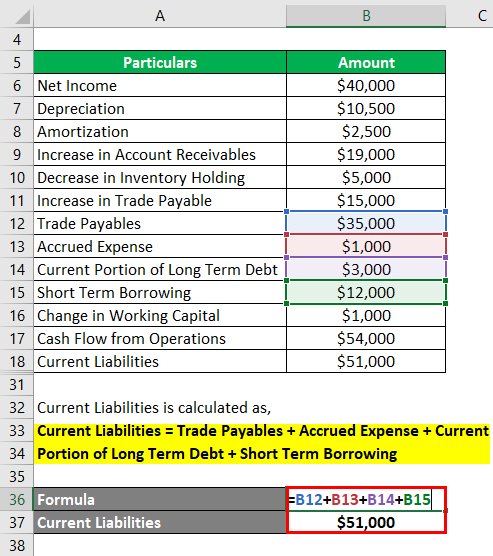

. Current Ratio Current Assets Current Liabilities 10. Cash Flow From Operations CFO a Net Income b Depreciation Amortization - c One-Time Adjustments - d Change in Working Capital Components of CFO. Operating Income also known as Operating Income Before Interest Expense and Taxes divided by Interest Expense Times Interest Earned Ratio.

Industry Ratios included in Value Line. Domicile also seems to have some bearing on the level of cash held. A higher than industry average current ratio indicates that the company has a considerable size of short-term assets value in comparison to their short-term liabilities.

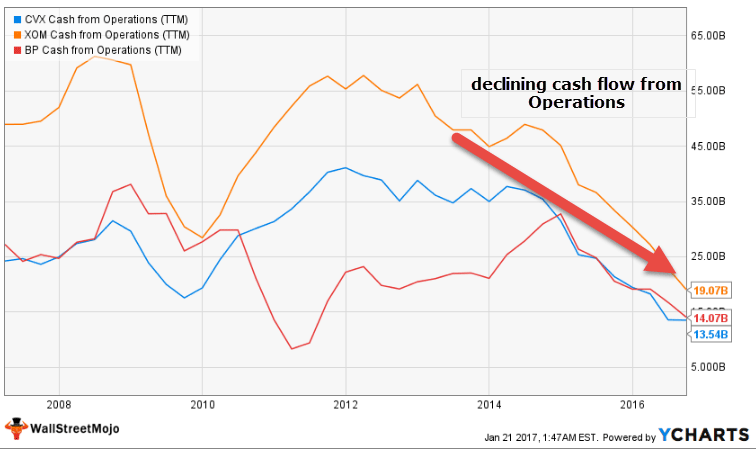

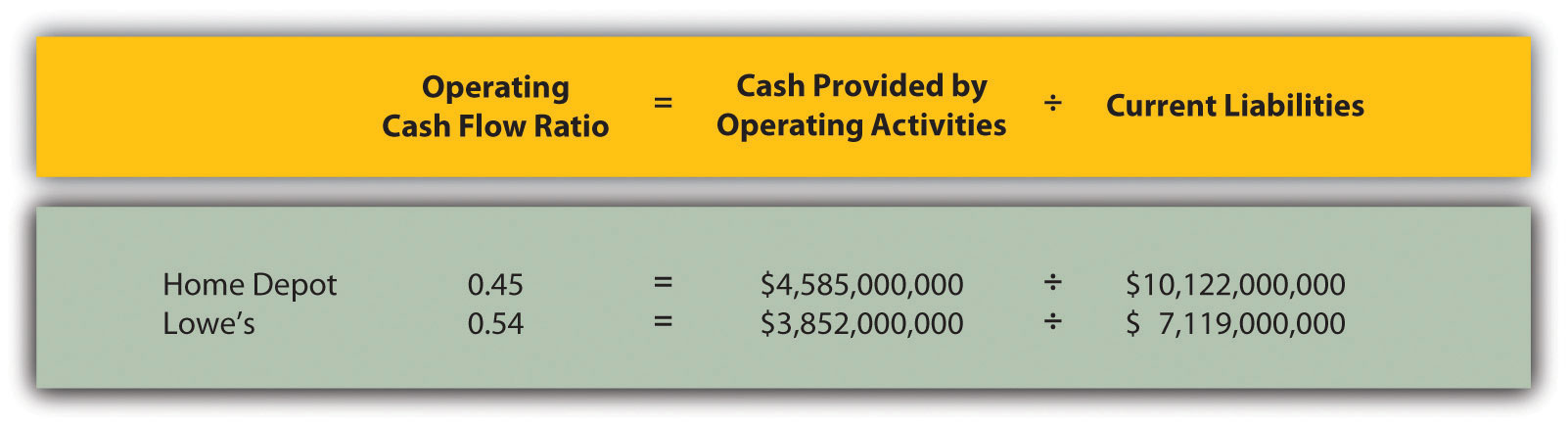

ROE Return on equity after tax. Thus investors and analysts typically prefer higher operating cash flow ratios. The Operating Cash to Debt Ratio measures the percentage of a companys total debt that is covered by its operating cash flow for a given accounting period.

Search Tools Industry Search. The price-to-cash flow ratio is a valuation ratio useful when a business is publicly traded. Cash flow adequacy ratio is a metric that is used to determine if a company can pay for its short-term expenses.

Liquidity ratios Current ratio Quick ratio Cash ratio Operating cash flow ratio Industry Average Industry 2019-20 2020-21 2021-22 Average Revenue 49 45 37 4366666667 Employment 3 19 23 24 Wages 53 4 4 4433333333 Industry Income Statement Assumption SHL Annual Revenue change. BizMiner provides drill-down industry code and keyword search methods to find the best. Performance relative to debt is a key measure of a trucking companys financial strength.

But in 2013 it was covered 11 times 220002000 11. This compares to 14 for those industries with the largest cash balances at 20-40 of sales. It is used by investors and lenders to check if a company is likely to make more profit in the future or not.

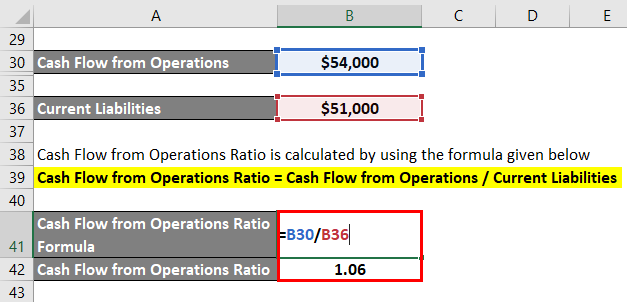

The operating cash flow ratio is a measure of a companys liquidity. The average for each of these annual figures over the complete 20 year period was 143. A nice rule of thumb shortcut would be to remember that net margin probably averages around 10 and operating margin averages around 5 more than that.

This means that there is at least 150 in operating cash flows to pay off every 1 of interest payments. Here is a list of the major indices and their average annual pre-tax return over the last two and three-quarter years. Net Income Found in the companys Income Statement Net income is an accounting metric that includes items that dont affect cash.

ROA Return on assets 11-01. This ratio is generally accepted as being more reliable than the priceearnings ratio as it is harder for false internal adjustments to be made. Whereas the opposite indicates.

This corresponds to a value of 1 or little higher than 1. Meaning the interest of The Learning Company was covered 9 times. The Philippines Hong Kong China and Brazil would appear to hold the largest cash balances at.

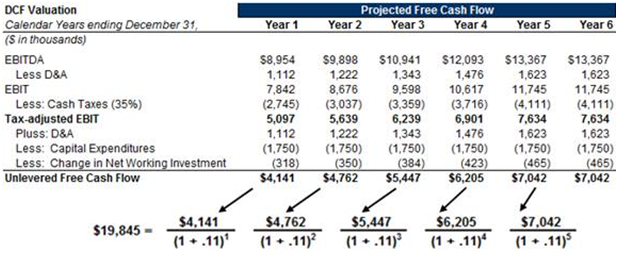

Within Energy sector 3 other industries have achieved higher Quick Ratio. Free cash flows are calculated as follows. If the ratio falls below this then it may indicate that a company is struggling to finance its debt or underperforming when it comes to its debt management.

In other words they have at least 6 million in operating cash flow for every 10 million in debt. If the operating cash flow is less than 1 the company has generated less cash in the period than it needs to pay off its short-term liabilities. Typically the cash flow coverage ratio for most businesses should be at least 15x.

Price to Cash flow ratio for the Retail Apparel Industry Retail Apparel Industrys current Price to Cash flow ratio has decreased due to shareprice contraction of -1656 from beginning of the forth quarter and due to the sequtial cash flow for the trailig twelve month period contraction of -1422 to Pcf of 1242 from average the Price to Cash flow ratio in the third. Second-tier companies have a cash flow-debt ratio between 30 percent and 60 percent. Quick Ratio total ranking fell in contrast to the previous quarter from to 81.

It measures the amount of operating cash flow generated per share of stock. Inventory Current Liabilities. This usually represents the biggest stream of cash that a company generates.

Net Worth Industry Search. 75 rows 27 - Printing Publishing And Allied Industries 67 032. Net Worth Current Ratio Days Payable Quick Ratio Total Liabilities.

FCF Earnings Before Interest Tax x 1 Tax Rate Depreciation Amortization Change in. The Times Interest Earned Ratio is. The difference between the operating cash flow ratio and the current ratio is that the operating cash flow ratio assumes that cash flow from operations will be used to pay off current liabilities whereas the current ratio assumes that current assets will be used.

The strongest sport a cash flow-debt ratio of 60 percent or greater. Indeed the ten sub-sectors with the lowest cash at 5-8 of sales commanded an operating margin averaging just 6. Compare this to the 89 average from the research I did on historical average net margins.

On the trailing twelve months basis Due to increase in Current Liabilities in the 1 Q 2022 Quick Ratio fell to 026 below Oil And Gas Production Industry average. The operating cash flow refers to the cash that a company generates through its core operating activities. This may signal a need for more capital.

18000 2000 9. Business Revenue Current Liabilities. In 2014 Times Interest Earned was.

Operating Margin Income Tax Rate Net Profit Margin Return on Total Capital Return on Shareholder Equity Retained Earnings to Common Equity All Dividends to Net Profit Average Annual Price to Earnings Ratio Relative Price to Earnings Ratio Average Annual Dividend Yield.

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Price To Cash Flow Formula Example Calculate P Cf Ratio

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Cash Flow To Debt Ratio Meaning Importance Calculation

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

Cash Flow Available For Debt Service Cfads Formula Calculation

:max_bytes(150000):strip_icc()/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

How Is The Statement Of Cash Flows Prepared And Used

Price To Cash Flow Ratio P Cf Formula And Calculation

Operating Cash Flow Ratio Calculator

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

Price To Cash Flow Ratio P Cf Formula And Calculation

Price To Cash Flow Formula Example Calculate P Cf Ratio

Operating Cash Flow Ratio India Dictionary

Operating Cash Flow Ratio Formula Guide For Financial Analysts

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)